Pocket Option's complete verification guide

What is verification?

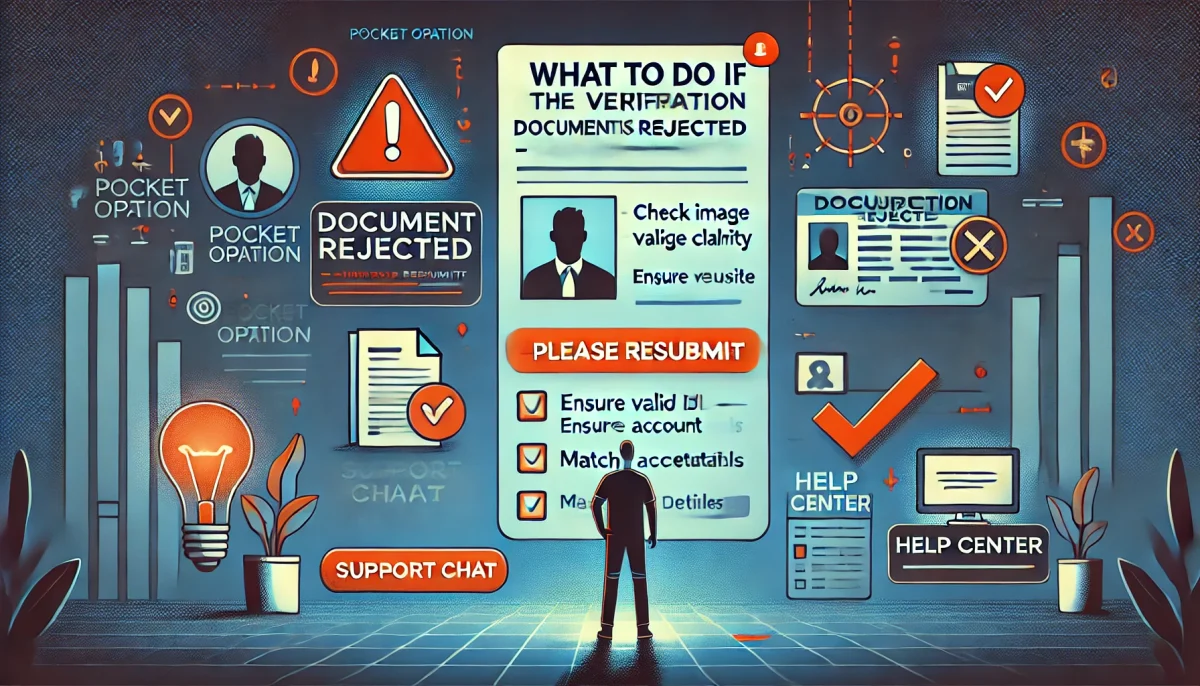

Verification is a mandatory procedure through which the binary option broker confirms the trader's identity by verifying passport details and residential address. The platform applies multi-level verification, where artificial intelligence

analyzes the documents and biometrics, and the finished result comes in a notification.

By the way, the query "pocket option verification" is often found in search engines, so the platform publishes instructions right in the help center. Two or three minutes of study will help you avoid unnecessary questions and speed up access to the

to the bill.